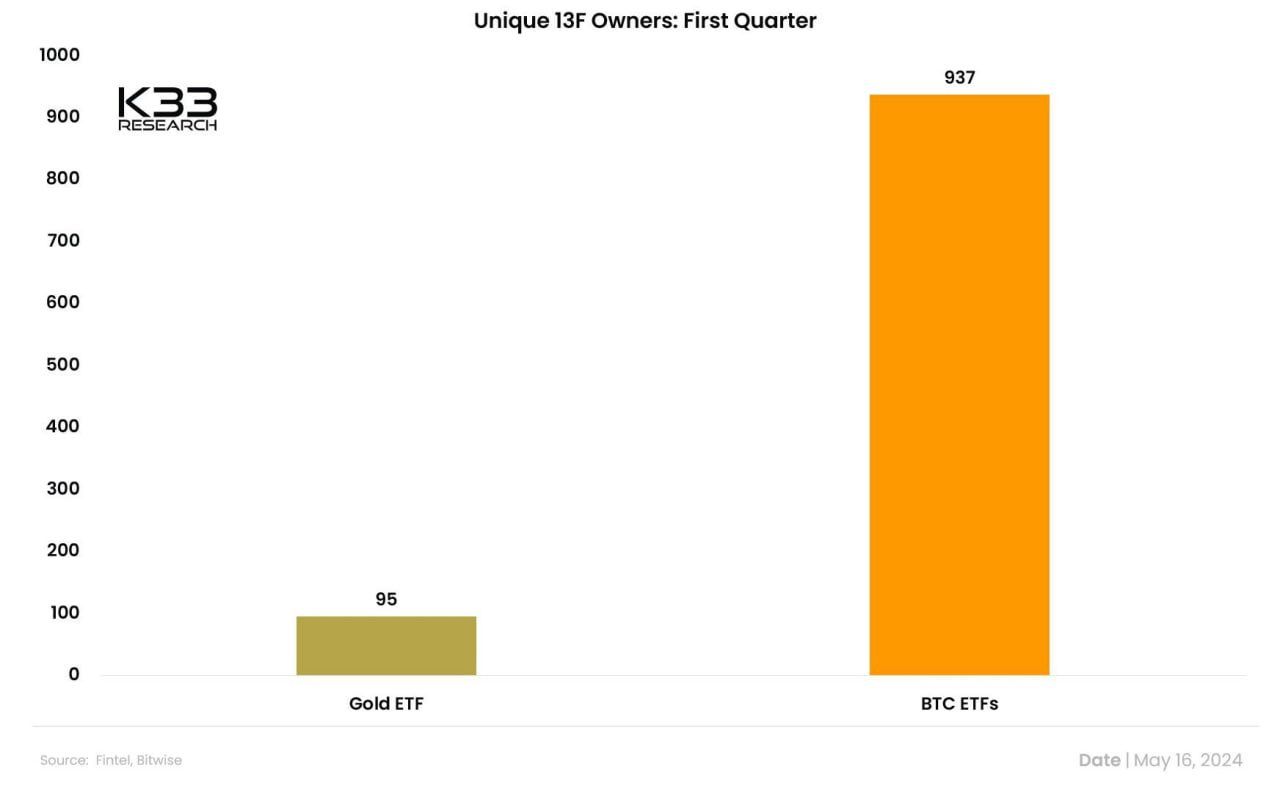

It's often said that numbers don't lie, but in reality, even if the numbers themselves don't lie, it all depends on how you interpret them. Take a look at this chart.

937 financial institutions reported buying Bitcoin spot ETFs in Q1 2024. By comparison, gold ETFs attracted just 95 financial institutions over the same period, almost 10 times less.

Bitcoin influencers will tell you that you can only be Bullish when you see this. If you only look at Bitcoin from the point of view of financial speculation, it's certain to make you Bullish. You'll be thinking that more and more financial institutions in the world of Bitcoin Spot ETFs mean more and more fresh money. And fresh money means a higher Bitcoin price...

That's a fact. If you take a longer-term view, as I'm trying to do, you'll see things in a different light.

These financial institutions aren't buying Bitcoin. They buy shares in Bitcoin Spot ETFs from BlackRock or other financial giants. They are not buying the idea of Bitcoin as a superior alternative system, but simply Bitcoin as a store of value embedded within the current flawed system.

BlackRock doesn't even own the private keys to its Bitcoin, delegating this to a third party, Coinbase. The centralization found here runs counter to the very idea of Bitcoin: Don't Trust, Verify.

For some, this poses no problem as long as the price of Bitcoin in weak money continues to rise. That's their right, after all, but let them understand that if Bitcoin is integrated into the current system, the Bitcoin revolution will not be able to reach its full potential.

Worse still, Michael J. Saylor himself claims that Bitcoin as a medium of exchange is a distraction. Yet, this is the very meaning of Bitcoin, invented by Satoshi Nakamoto. When you realize what's happening in the world of Bitcoin, you're in for a big disappointment.

Ordinals, Subscriptions, and Web3 projects on the Bitcoin system are all moving in this direction of ever-increasing speculation.

Exit the people's liberating monetary revolution!

Indeed, all the Bitcoin held (aka blocked) by Coinbase on behalf of the financial giants will not be used by those who need Bitcoin more than ever. And that's the problem. BlackRock and the other financial giants like Bitcoin only as a store of value they can control within the current system.

It's these financial giants who are getting their hands on Bitcoin, which won't be used for what it was designed for. Do you think that unbanked people who need Bitcoin to access basic banking services will benefit from this integration of the Bitcoin system into the existing system?

The answer is NO, but the Bitcoin influencers will continue to make you believe that all this is good for Bitcoin. It's up to you to ask yourself the right questions. Every time a bank is announced as holding Bitcoin, ask yourself whether it actually owns Bitcoin, or whether it owns shares in a financial product that is labeled Bitcoin and which is ultimately centralized in the hands of Coinbase.

You'll see what the answer is. You may not like it if you're not prepared to hear the inconvenient truth of what's going on. The same Bitcoin influencers who criticized Ethereum not so long ago are now rejoicing that the SEC is about to approve Ethereum Spot ETFs.

Surprising? Not at all, when you realize that these influencers are only interested in one thing: profit above all else. That's their right, but it's not what the Bitcoin revolution is all about, which is to reconcile individual interests with those of the collective, thanks to a revolutionary monetary system that must be seen as a superior alternative to the current system.

To see Bitcoin becoming more and more integrated into the current system is a definite disappointment and a major risk for the future of the Bitcoin revolution. Bitcoin must remain this superior alternative if the full potential of its revolution is to be achieved. Let's hope that those who still want to fight for this ideal are able to gain the upper hand over the Bitcoin influencers who see only through speculation.

This is the battle of the coming years for the success of the Bitcoin revolution.